Piece of Mind - Worry Free Package

Cliant Care Package

Why do you need

Ever since the IRS has been put in charge of administering non-tax-related matters (economic impact payment aka stimulus payments, marketplace insurance, payments of the advanced child tax credit, unemployment refund checks, etc.), we have seen a tremendous uptick in all kinds of notices being sent to the taxpayers.

For 2025 there is a new reporting requirement for gross amounts when you sell items on platforms like eBay, PayPal, Square, Stripe, or Venmo, etc. Third-party settlement organization (TPSOs) must report transactions when total payments to a participating payee exceed $5,000. This raises questions about what happens if you sell an item on eBay at a loss, or if family or friends send you money through PayPal or Venmo.

In 2022, the IRS issued 17 million notices questioning items on income tax returns that were just filed. It took an average of 240 days, up from 74 days, to resolve these. All these notices require a response.

Per the 2022 Inflation Reduction Act, signed into law, the IRS received $80 billion in additional funding, their largest budget increase ever. Most of these funds are being used to audit unsuspecting taxpayers who did nothing wrong.

It is never a good feeling to get a letter from the IRS. The letters are not always very clear to understand and can be easily misunderstood. If you do not respond properly this can cause even bigger problems and higher penalties. Sometimes, even if you clearly understand what is needed and you get in touch with the IRS they will ask you more probing questions and there is a big chance you are not prepared to answer them.

You see, many people think that responding to notices or IRS representation is automatically included in the tax preparation fee. In the past, we have done everything in our power to accommodate you and respond to the IRS on your behalf free of charge. Unfortunately, due to a high number of notices expected to be sent from the IRS, we will not be able to offer a responsive service as free accommodation anymore.

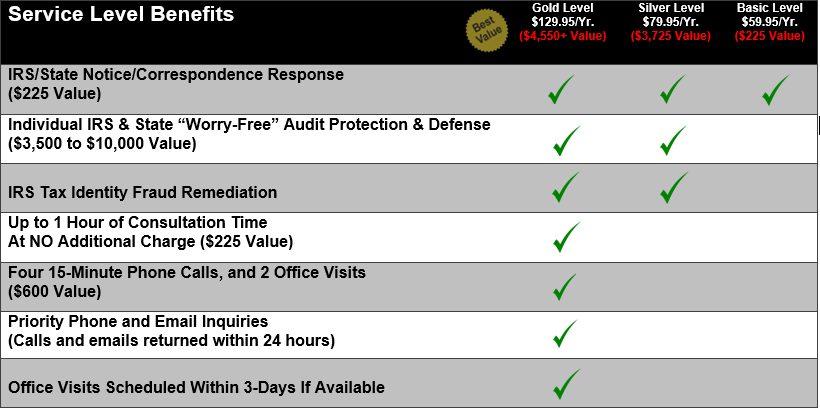

Instead of charging you an hourly fee of $225/hr for this service (like most other tax preparers do) we have come up with the Client Care Package. This is a worry-free peace of mind service that will keep our sanity when it comes to IRS letters, audits, and Identity Theft notices. For a fraction of an hourly price, we can add this package to your tax preparation invoice. Doing so will obligate us to respond to the notices you receive from the IRS.

You would just call us up and tell us to “handle” any income tax notice or audit by calling and/or going to the IRS for you. If the IRS sends you a notice, we will file an appropriate form on your behalf and will work with the IRS on the issue without any additional time investment or expense on your part.

That way you can go about your daily life knowing that you have a bonafide expert professional on your side dealing with the IRS so you can sleep better at night.

This sure beats having to negotiate with the tax authorities yourself without knowing any of the tax laws. Representing yourself is a surefire way of getting manhandled by the IRS and having to pay through the nose for back taxes and penalties.

Sure, you might think, “I’ll just call the phone number on the notice and see what this is all about,” but be prepared that you’re about to start a very long period of wasted time dialing, being put on hold, and even being hung upon. That’s right—you can be waiting on the phone for 60 minutes and then they hang up on you! The IRS calls this a “courtesy” disconnect!

Let’s face it, when it comes to the IRS, you’re guilty until proven innocent. How are you supposed to make sense of the letter they sent you that can be anywhere from 2 to 11 pages that are filled with verbiage that’s pretty much intended for an expert to understand?

Finally, An Inexpensive and Easy Way to Protect Your Family From The High Cost of An Audit and IRS Inquiries

Responding to IRS and State income tax notices questioning items on your return and audit representation can range into thousands of dollars. With the increase of all the tax law changes and the government stimulus plans, tax identity theft cases and the frequency of audits have increased over the past years there is a big chance you will receive a correspondence from the IRS – our Client Care Package is the answer.

For a small annual fee that’s added to your tax preparation invoice, we’ll shield and protect you from ever having to deal with the tax authorities by yourself in case you get a notice from the IRS or state tax authorities questioning items on your return that we just filed for you. And if you ever have to meet with an agent in person, we’ll attend the meeting on your behalf. You don’t even have to go.